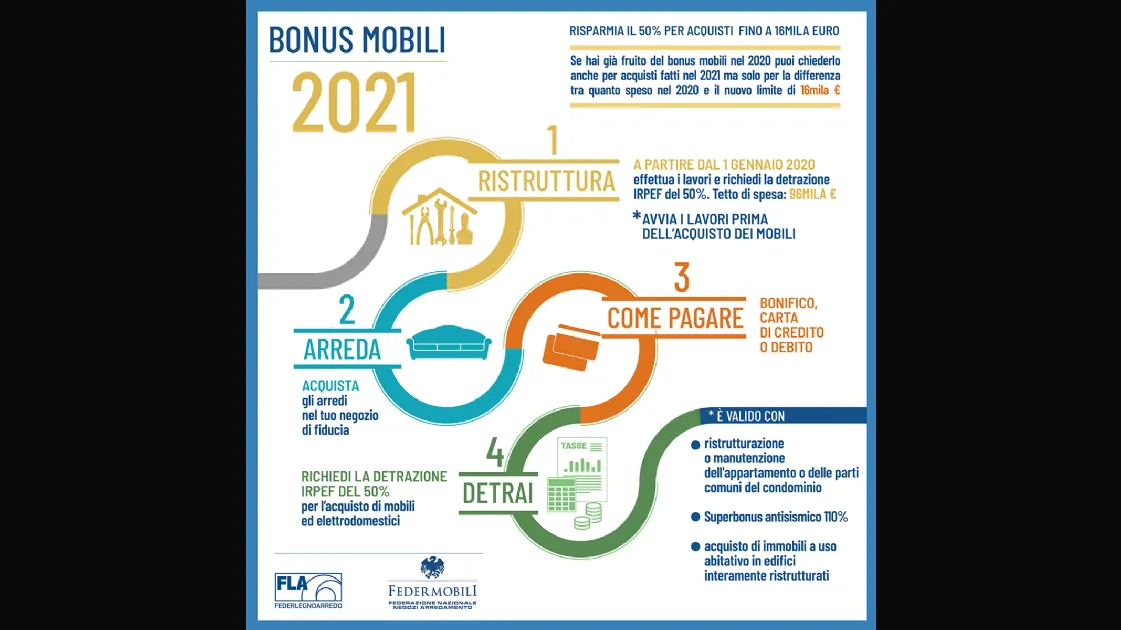

Furniture Bonus 2021

Furniture and Appliances Bonus 2021

All the news that comes with the Budget Law approved in December:

the tax breaks are also extended for 2021 and the MAXIMUM ROOF INCREASES TO 16,000 EUROS, 2021 is the right year to redo the look of domestic interiors.

Taxpayers who benefit from the deduction for building heritage recovery interventions can benefit from a further tax reduction for the purchase of furniture and large appliances with an energy class of no less than A+ (A for ovens), for for which the energy label is foreseen, aimed at furnishing buildings undergoing renovation.

The deduction, which must be divided among those entitled in ten equal annual installments, is due on the expenses incurred from 1 January 2020 to 31 December 2021 and is calculated on a total amount not exceeding 16,000 euros.

It is possible that the expenses for the purchase of furniture and large household appliances are incurred before those for the renovation of the property, provided that the renovation work on the property for which the goods are intended has already begun. In other words, it is sufficient that the start date of the works is prior to the one in which the expenses for the purchase of furniture and large appliances are incurred; therefore it is not necessary that the renovation costs be incurred before those for furnishing the home. The taxpayer who carries out renovation works on several real estate units will be entitled to the benefit several times. The maximum amount of 16,000 euros must, in fact, refer to each housing unit undergoing renovation.

WHICH GOODS

The deduction is for expenses incurred from 1 January 2020 to 31 December 2021 for the purchase of:

- New furniture

- Large new appliances with energy class no lower than A+ , (A for ovens), for appliances for which the energy label is required.

By way of example, eligible furniture includes beds, wardrobes, chests of drawers, bookcases, desks, tables, chairs, bedside tables, sofas, armchairs, sideboards, as well as mattresses and lighting fixtures which constitute a necessary completion of the furnishing of the property object of restructuring.

On the other hand, purchases of doors, flooring (for example, parquet), curtains and drapes, as well as other furnishing accessories are not eligible. As far as large appliances are concerned, the law limits the benefit to the purchase of types with an energy label of class A+ or higher, A or higher for ovens, if the energy label is mandatory for those types. The purchase of large appliances without an energy label can only be facilitated if the energy label obligation is not yet envisaged for that type. For example, large household appliances include: refrigerators, freezers, washing machines, dryers, dishwashers, cooking appliances, electric stoves, electric hotplates, microwave ovens, electric heating appliances, electric radiators, electric fans, air conditioning appliances .

The amount of expenses incurred for the purchase of furniture and large appliances can also include the costs of transport and assembly of the goods purchased, provided that the expenses themselves were incurred with the payment methods required to benefit from the deduction (bank transfer , credit or debit cards).

It is not required that there is a connection between the furniture and the renovated environment. In other words, the purchase of furniture or large appliances can be facilitated even if the goods are intended to furnish an environment other than those subject to building interventions, provided that the property is in any case subject to building interventions.

FULFILLMENTS

In order to take advantage of the tax benefit, the taxpayer must make payments by means of

- Bank or postal transfers,

- Credit or debit cards.

As specified in circular no. 7/2016, if the payment is arranged by bank or postal transfer, it is not necessary to use the one (subject to withholding) specially prepared by banks and Poste Spa for building renovation costs .

For simplification needs related to the types of goods that can be purchased, it is possible to pay for the purchase of furniture or large appliances also by credit or debit card . In this case, the payment date is identified on the day of use of the credit or debit card by the holder, highlighted in the electronic receipt of the transaction, and not on the day of debit on the current account of the holder. On the other hand, payment by bank checks, cash or other means of payment is not permitted

The documents to be kept are:

- Proof of payment (transfer receipt, transaction receipt, for payments by credit or debit card, debit documentation on the current account)

- The invoices for the purchase of the goods, showing the nature, quality and quantity of the goods and services acquired.

SOURCE: Revenue Agency